FinTech Excellence / iSoftStone Ranked among the Top 50 Chinese Enterprises of FinTech for 2021

iResearch recently released the Insights into Development of China's FinTech Industry, in which the list of Top 50 Chinese Enterprises of FinTech for 2021 was also publicized. iSoftStone was successfully shortlisted and honored as 2021 China FinTech Technology Service Provider Excellence.

The Top 50 Chinese Enterprises of FinTech for 2021 was jointly nominated, evaluated and shortlisted by iResearch in collaboration with tens of Fin-Tech experts from banks, insurers, securities institutions and technology academic institutions. The evaluation focuses on "Scientific and Technological Creativity and Technical Output Capability" in order to provide empirical references for the technological innovation practices in financial industry and selection of partners by financial institutions.

In 2020, China's financial institutions made a technical investment of 269.19 billion yuan and China's FinTech has entered the phase of trusted technology-driven advanced intelligentization. It is expected that the total investment will reach 575.45 billion yuan by 2024 and China's financial industry will reach the phase of efficient development characterized by digital innovation.2021 is the last year of the Financial Technology (FinTech) Development Plan (2019-2021) with remarkable achievements in technological innovation of financial institutions represented by banks. With financial applications and technological innovations on a manufacturing base, China's financial industry has started a systematic digitalization driven from the top down.

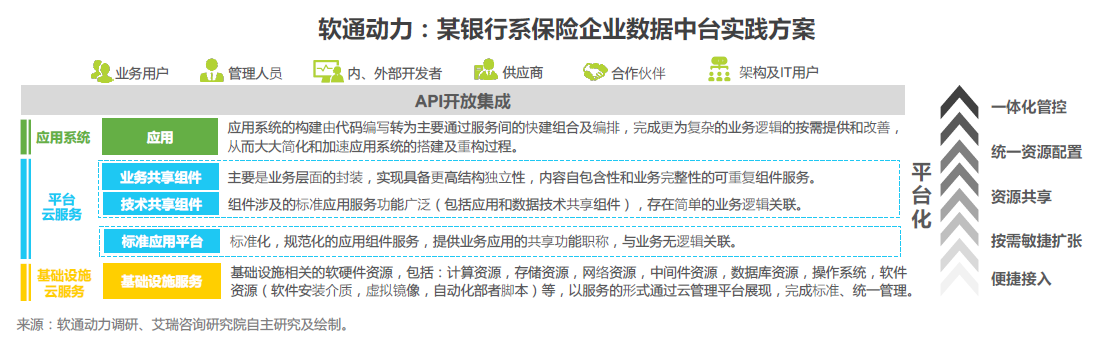

When it comes to the technological innovation in niche sectors, iResearch made a research on the efficiency development quadrant of China's insurance technology in 2020-2021 and through a great number of empirical surveys on "data center manager" found that iSoftStone was leading in the domestic industry in data center manager development practices and demonstrated excellent advantages in four dimensions, namely: excellent data analysis capability, excellent system development, excellent data collection capability and excellent data trusted computing capability.

"iSoftStone Fintech" is a brand officially launched by iSoftStone on the basis of R&D and service capability accumulated in financial field with more than 10 years. Its digitalization delivery team currently possesses the full-stack service capability in a series of niche sectors, including counseling, development, testing, operation & maintenance, BI technical service, data analysis service and digitalized operation and thus can provide comprehensive services from software and technical services and solutions to innovation and digital transformation services for diversified pan-financial clients.

iResearch believes that iSoftStone has not only established a financial technical strategy of "Trust + Intelligence + Inclusion", but also incorporated relevant capabilities into its basic technology system. To help with the digital upgrading of financial institutions, iSoftStone not only owns a leading strategic perspective (helping financial institutions establish a digital strategy system), but also enjoys outstanding practical abilities (helping financial institutions to realize their digital strategies).

The three focuses of financial institutions' technical investments and digital innovation practices will be basic technology development and upgrading, demand-oriented digitalization practice and digital financial infrastructure-based innovation practice in the next couple of years. In line with the latest technological development, iSoftStone will drive its innovation and development on the core of big data, cloud computing and other technologies and provide quality financial products and services to clients.

News