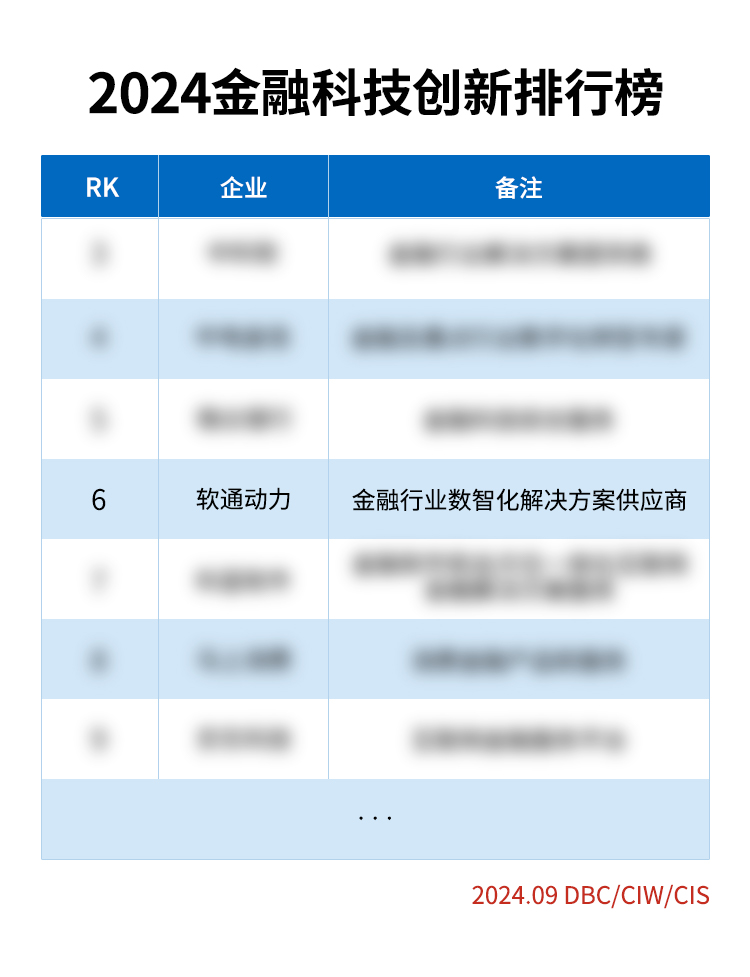

Honor Highlight: iSoftStone Ranks Sixth in the 2024 FinTech Innovation List

Recently, the "2024 FinTech Innovation List", jointly reviewed by the Internet Weekly of the Chinese Academy of Sciences, the Information Research Center of the Chinese Academy of Social Sciences, eNet Research Institute, and DBC Consulting, was officially released. iSoftStone achieved an impressive sixth place on the list, thanks to its deep engagement and active innovation in the FinTech sector.

In the wave of digital transformation, iSoftStone has been dedicated to the financial industry for nearly 20 years, consistently keeping pace with new trends in FinTech. The company actively embraces cutting-edge technologies such as artificial intelligence, big data analytics, and blockchain, enhancing its data processing and risk management capabilities to optimize customer experience. To address the high concurrency, high availability, and high performance characteristics of financial transaction settlements, iSoftStone has established a comprehensive solution system that spans from chips and devices and equipment to operating system adaptation, application middleware, domestic databases, and applications. In early 2021, iSoftStone officially established its financial sub-brand, iSoftStone FinTech, which is an important segment in the vertical industry. iSoftStone FinTech is committed to empowering the high-quality development of financial businesses through technological innovation.

In the field of AI applications, iSoftStone FinTech has launched a series of AI solutions for the FinTech sector, such as the AISE integrated platform and AI financial advisory assistant, accelerating the technological implementation and innovation upgrade process for clients in the financial and broader financial sectors. In recent years, iSoftStone FinTech has deeply engaged in the GenAI, bringing new innovations and transformations to industry clients. Through the application of artificial intelligence technologies, the company provides private, intelligent, and customized professional services to financial clients, enabling efficient business processing and precise risk assessment.↵ In customer service, intelligent customer service robots can provide answers and assistance to clients 24/7, greatly enhancing customer satisfaction. In risk assessment, machine learning algorithms analyze vast amounts of data to accurately predict risks, providing strong support for financial institutions' decision-making.

With years of industry experience, iSoftStone has accumulated a wealth of scene digital application solutions. By gaining deep insights into various industry fields and focusing on building customer ecosystem scenarios, the company has created a comprehensive product matrix to offer diverse and efficient integrated digital technology services to industry clients. In 2024, with the integration of Tongfang Computing's business, iSoftStone officially established an "Integrated Software-Hardware" service framework, providing end-to-end full-stack services from consulting to solutions and applications. Through continuous optimization and self-upgrading, the company meets the diverse needs of various industries in their digital transformation processes.

Looking ahead, iSoftStone will adhere to its core philosophy of "innovation, integration, and service", committed to continuously enhancing its technological innovation capabilities and service levels. We aim to contribute more significantly to the innovation and development of the financial industry. The company hopes to collaborate with partners across various fields to create a more prosperous and intelligent future for FinTech and to collectively embrace a bright tomorrow for the industry.

News